Do you have a decent amount of savings but are unsure how to generate a profit from it? For people who are up to the challenge, their savings might be used in different areas such as opening a business, investing in securities, etc. For people who prefer stability, they would choose to put their savings into their bank to earn monthly interest. Read the article below to discover why you should open a savings account, how you can earn interest and other factors to be consider before opening a savings account.

REASONS WHY YOU SHOULD OPEN A SAVINGS ACCOUNT

Some people often think that opening a savings account does not generate as much profit as using it for investment purposes such as real estate, securities investment, etc. Hopefully the reasons provided below would help you to have a different perspective of opening a savings account.

1/ Profit is guaranteed

This is the most obvious benefit when it comes to opening a savings account at a bank as your savings will continue to generate the same amount of interest every month. You can either choose to receive your monthly interest per month, or wait until the end of the term and extend your savings account, plus interest, to continue generating more interest.

With a savings account at a bank, you need not worry about situations where your investment leads to losses. Instead of worrying about the plummeting stock prices or how to make your business run smoothly while generating enough profit, you just have to sit back knowing that your savings account is generating a profit by itself.

2/ Flexible in withdrawing your savings account

To offer a convenient experience to customers, most banks have allowed customers to withdraw from their savings account ahead of time. Although this is not encouraged as it would not bring you as much interest as it could, however, most banks have offered this so that customers can get their Money back in cases of emergencies or unexpected problems.

WHAT DO YOU NEED TO CONSIDER BEFORE OPENING A SAVINGS ACCOUNT?

1/ Choose a suitable term

Most banks offer several duration for savings (from 01 to 18 months or even longer). The longer the term, the higher the interest rate. Hence, before putting money into your savings account, you need to carefully evaluate your financial situation to have an estimate of how long you can go without using this money. This will help you to choose the most suitable term for yourself.

For instance, you have 10.000.000 VND in savings and you expect not to use this money for at least the next 8 months. In this case, you can choose the term of 6 months for your savings account.

Banks nowadays are also transparent in withdrawing and getting interest. You will get a quarterly or monthly notice of your earned interest and the remaining length of time before your due date to be more proactive in deciding to either continue maintaining your savings account or withdraw your money.

2/ Choose a bank with competitive interest rates and a good reputation

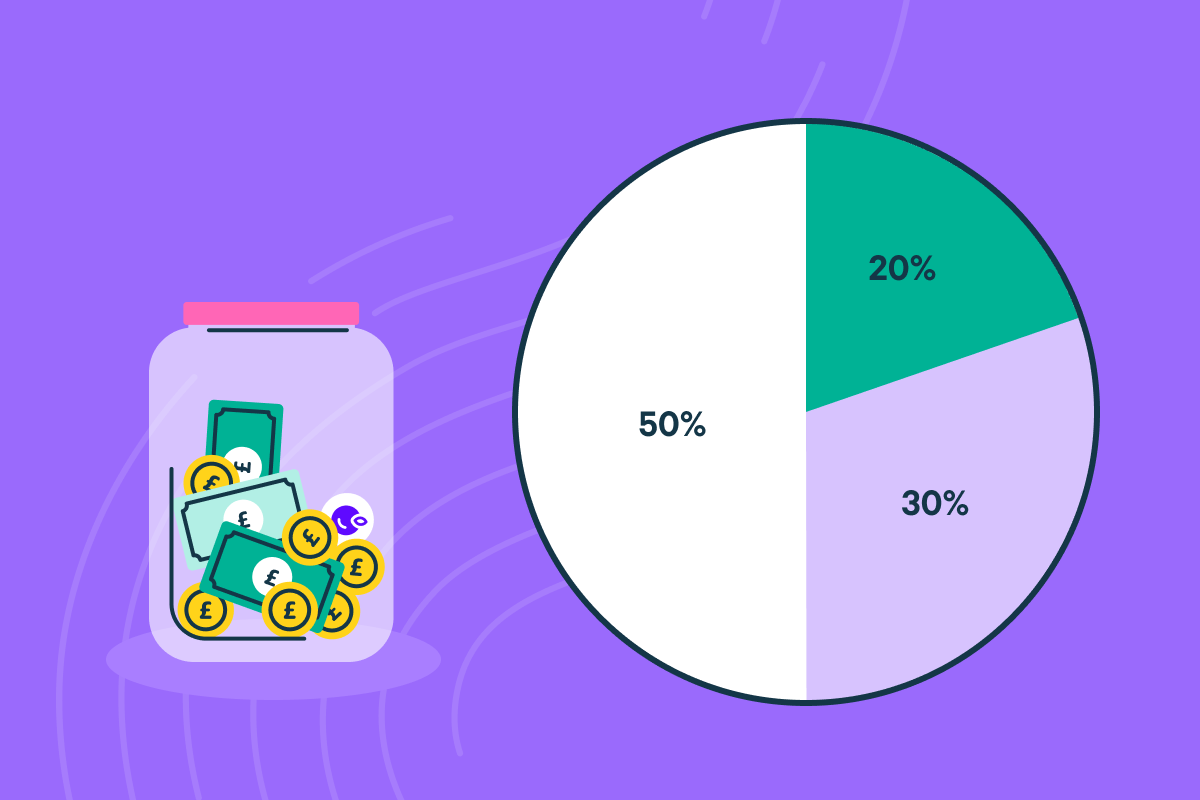

Currently there are 3 main banking groups, including: State Bank, Joint Stock Commercial Bank and foreign-invested banks or joint-venture banks.

The level of safety associated with having a savings account at state banks, such as Agribank, Vietcombank, Vietinbank, BIDV, etc, is high. However, their interest rates are likely to be lower than the other two groups.

Joint Stock Commercial banks often offer interest rates that are 1% – 1.5% higher than interest rates offered by state banks. At the same time, banks in the third group are known to offer the highest interest rates.

3/ Choose a bank with a near branch location from your home

This is often overlooked by many people. However, you will not be able to anticipate every unexpected situation that requires you to withdraw your money ahead of time. When you choose a bank with a high interest rate but it is located too far from where you live, this might cause a lot of inconvenience when you need to withdraw your savings account.

DID YOU KNOW?

With Timo, you will not have to worry about choosing a bank with a near branch location from your home as you can easily open a savings account online right in the Timo app. With only 1.000.000 VNĐ, you can open a Term Deposit in the blink of the eye.

Additionally, Timo’s Term Deposit allows users to split their savings amount into smaller Term Deposits. In unexpected situations, this feature will help you to withdraw one Term Deposit ahead of time while continuing to earn interest for the remaining Term Deposits. Find out more about Timo Term Deposit here.

[av_table purpose=’pricing’ pricing_table_design=’avia_pricing_default’ pricing_hidden_cells=” caption=” responsive_styling=’avia_responsive_table’ custom_class=” av_uid=’av-7xbtg7′] [av_row row_style=” av_uid=’av-662ifb’][av_cell col_style=” av_uid=’av-3i9frb’]

Important notes:

From 5th July 2019, foreign nationals are no longer eligible for Goal Save Accounts as stated in Circular no. 48/2018/TT-NHNN. For Term Deposit Accounts, foreigners with a valid document proving residential status in Vietnam with at least 6 months validity will be eligible to open Term Deposit Accounts with a Term NOT greater than the remaining of its validity. Existing Term Deposits opened before 5th July 2019 will be continued until its maturity.

[av_button label=’Read the official announcement’ link=’manually,https://timo.vn/en/blog/regulations-for-foreigners/?utm_source=ENBlog=v’ link_target=” size=’small’ position=’center’ icon_select=’yes’ icon=’ue836′ font=’entypo-fontello’ color=’theme-color’ custom_bg=’#444444′ custom_font=’#ffffff’ custom_class=” admin_preview_bg=” av_uid=’av-1v35xz’]

[/av_cell][/av_row] [/av_table]