In a wide range of options, especially between digital banks and traditional banks, which option should you go with when it comes to opening a credit card? Below are the 3 main points that should help you to find out the answer.

1. Qualification criteria

While the explosion of 4.0 technology is still booming, many traditional banks still require a wide range of paperwork and financial proof from customers applying for credit cards. On the other hand, digital banks continue to find ways to digitalize the process of opening a credit card for customers.

Insteading of having to fill out the application form at the counter, with a Timo Mastercard, customers can apply online via the website or the Timo app before coming to Timo Hangout to pick up their cards. Although you still need to be qualified based on certain criteria, however, you can quickly check if you are qualified right at home via the website or the Timo app.

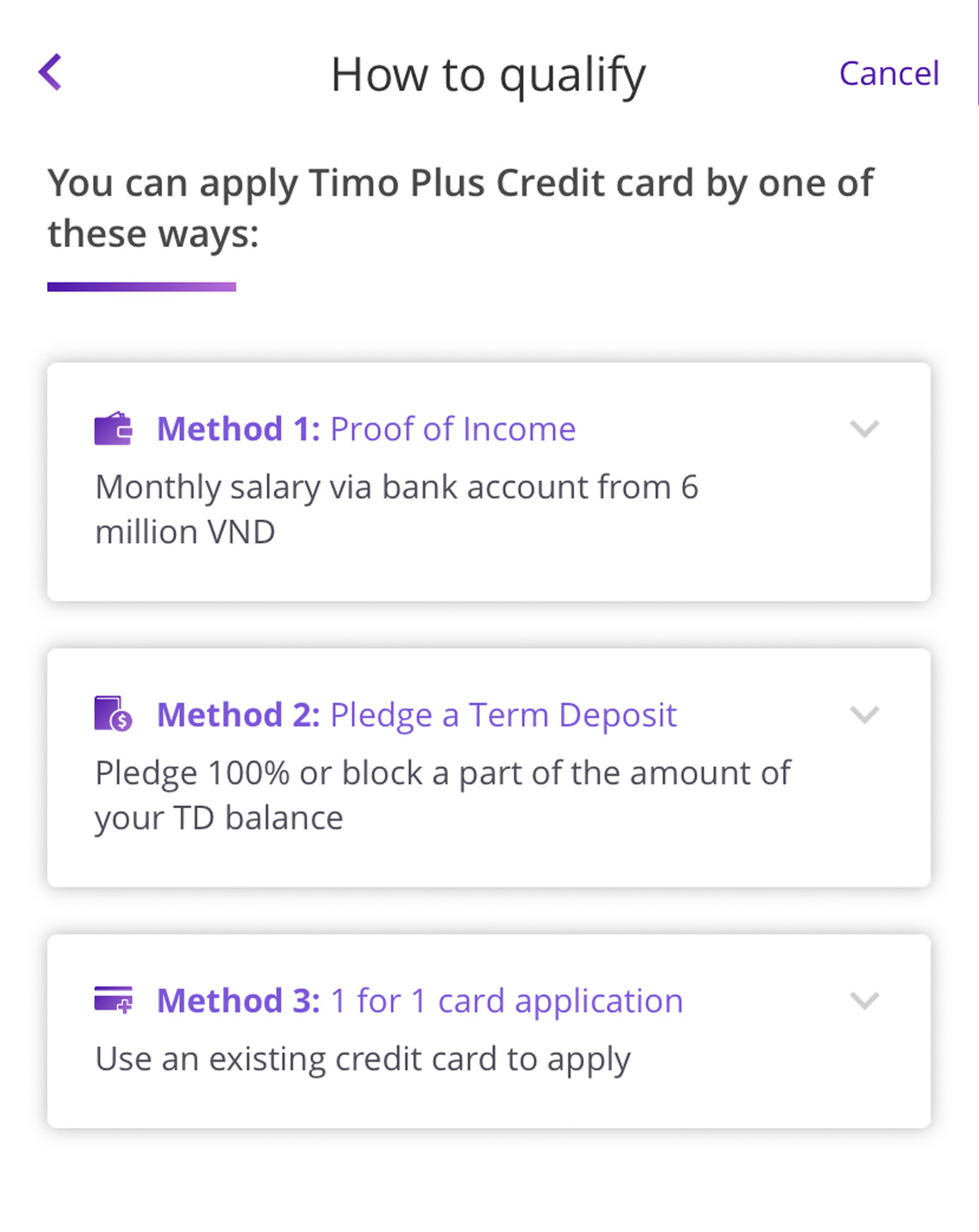

You can apply for a Timo Mastercard if you meet one of the qualification criteria below:

As mentioned above, Timo allows customers to self-check to see if they are qualified, choose the suitable qualification criteria for themselves, fill in the application form online and book a suitable appointment to pick up their card at the nearest Timo Hangout. The application process is shortened and digitized to make it painless for every potential credit cardholder.

2. Benefits received from the credit card

With dozens of credit cards issued by every bank in the country, you need to carefully consider the benefits provided to choose a suitable credit card for yourself.

Common benefits received from credit cards include:

– Online purchases and overseas use are allowed

– Spending reimbursement

– Credit card installments

Before applying for a credit card for yourself, you should see if your spending needs match your chosen bank’s benefits offered for credit cards. You can see some outstanding benefits provided for Timo Mastercard below:

– First annual fee is free of charge if 3 transactions are made within 30 days from the date of card issuance

– Interest for the first 45 days of use is free of charge

– Allow customers to quickly settle their repayment for any transaction made from their Timo Mastercard anytime and anywhere without having to wait for their monthly statement

– Allow customers to easily pay their transactions with a flexible installment scheme at all product/service providers in Vietnam

Find out other benefits associated with Timo Mastercard here.

3. Other benefits that you can get in addition to your card benefits

Unlike traditional banks, Timo offers other smart features right in the Timo app to help users manage their financial situation better and easily generate additional income from their savings money, including:

Online savings: You can easily achieve your savings goal with Goal Save or earn additional income with attractive interest rates offered by Term Deposit.

Fast Cash: Accidentally spending beyond your credit limit? Fast Cash will be your “financial savior” with an overdraft limit of up to 100 millions VND that can be approved in 30 minutes.

Payment request: Remind someone of the amount of Money they owe you politely and easily right within the Timo app.

Personal accident insurance and travel insurance

Open-end fund investment with VinaCapital

Find out more about our Timo Mastercard here.