Vietnam, like any other developing country, has been rapidly adopting technology in ways that improve their lives. Like banking! A once almost non existent sector is now being used by the Vietnamese community at large. The most basic banking products are Debit or ATM cards and Credit cards, both of which have similar features. Let’s look a bit more at the types of cards that exist in Vietnam and you can decide which card you want to open.

Bank cards that are popular here are

- Debit card – domestic payments

- Debit card – International payments

- Credit card – domestic & international payments

- ATM card – domestic withdrawals only

Often, a domestic debit card issued by banks can only be used to withdraw cash at ATM machines and can be called domestic debit cards.

Most banks in Vietnam issue two types of cards in parallel, allowing them to connect with a single account opened at that bank. The first is the local debit card – usually for local payments or withdrawals through NAPAS. The second is an international debit card – for international payments through renowned switch organizations like Visa, MasterCard, JCB or American Express.

|

Feature |

Domestic ATM /Debit cards |

International Debit cards |

Credit cards |

|

Cash withdrawals |

✔ |

✔ |

✔ Interest rate payable is very high |

|

POS transactions |

✔ May vary dependent on card issuing bank |

✔ Almost all POS machines accept Master and Visa cards |

✔ Almost all POS machines accept Master and Visa cards |

|

Online payments |

✔ For domestic payments only |

✔ For international and domestic payments |

✔ For international and domestic payments |

|

Earn interest on payment deposits |

✔ |

✖ |

✖ |

|

Scope of use |

Within Vietnam at POS / ATMs of banks in alliance with the domestic payment service provider (NAPAS) |

In Vietnam and overseas |

Worldwide |

|

Enjoy discounts |

✔ At local websites/ stores that accept ATM cards and if the retailer is affiliated with the issuing bank payment provider |

✔ At domestic & international websites/ stores that accept Visa / MasterCard and if the retailer is affiliated with the issuing bank / payment provider |

✔ At domestic & international websites/ stores that accept Visa / MasterCard and if the retailer is affiliated with the issuing bank / payment provider |

|

Bill Payments |

✔ |

✔ |

✔ |

|

Connect /Link Accounts |

✔ |

✔ |

✔ |

|

Main Use |

Transfers, Withdrawals, Payments |

Online Shopping, Withdrawals, POS, when travelling |

Online Shopping, POS, when travelling |

Using Cards when abroad

Gone are the days of carrying foreign currency when travelling or finding exchanges to convert your currency to that of the destination country. Not only is it a hassle to exchange foreign currencies, but some places require you to go to the bank. But most of all these methods are not safe, especially when carrying large sums of cash.

International Debit or Credit cards are ideal, safe and effective for any trip as they facilitate transactions in any currency across the world to withdraw cash, swipe at a POS terminals and for Online payments associated with Visa, Mastercard, JCB … However, be careful when using your card to avoid losing Money and instead enjoy the benefits. Here are some Tips to be prepared and avoid budgetary constraints when you travel:

· Check your debit or credit card statement to see if your balance or the credit line remaining is sufficient. If it is not enough, transfer more money to your account for expenses and contingencies.

· Check your signature on the back of the card and make sure it’s the same as that on the receipt when swiping your card at a POS machine.

· While most countries accept cards widely, it’s important to know which services accept card payments and be prepared for instances where cash is still the main method of payment.

· Research about promotions, discounts on flights, hotels and shopping festivals to get the most for your buck when travelling. Popular shopping festivals are:

+ Hong Kong, Singapore & Thailand Sales from June – August

+ Korea & Dubai Shopping Festivals from January – February

+ USA Outlet Shopping Festival in October .

· Check your bank’s privileges merchant list for discounts to help you save a nice chunk of change for other expenses on your trip.

· It’s important to note that withdrawing cash with an International Debit or Credit card will cost you more than withdrawing in the card issuing country, which would include a switch fee and an FX conversion fee.

· Keep your issuing bank’s hotline number handy for assistance in case of unexpected circumstances like card theft, card loss, ATM eating your card overseas.

· Register for online banking so that when you travel you can still access and manage your account in case your card is lost or stolen and report it to your bank to take the necessary action. No need to spend hours on your phone, racking up huge roaming charges to call your bank.

· Never save your card information on unfamiliar, untrusted websites. Always make sure all website URLs have the secure green lock icon in the URL section when shopping.

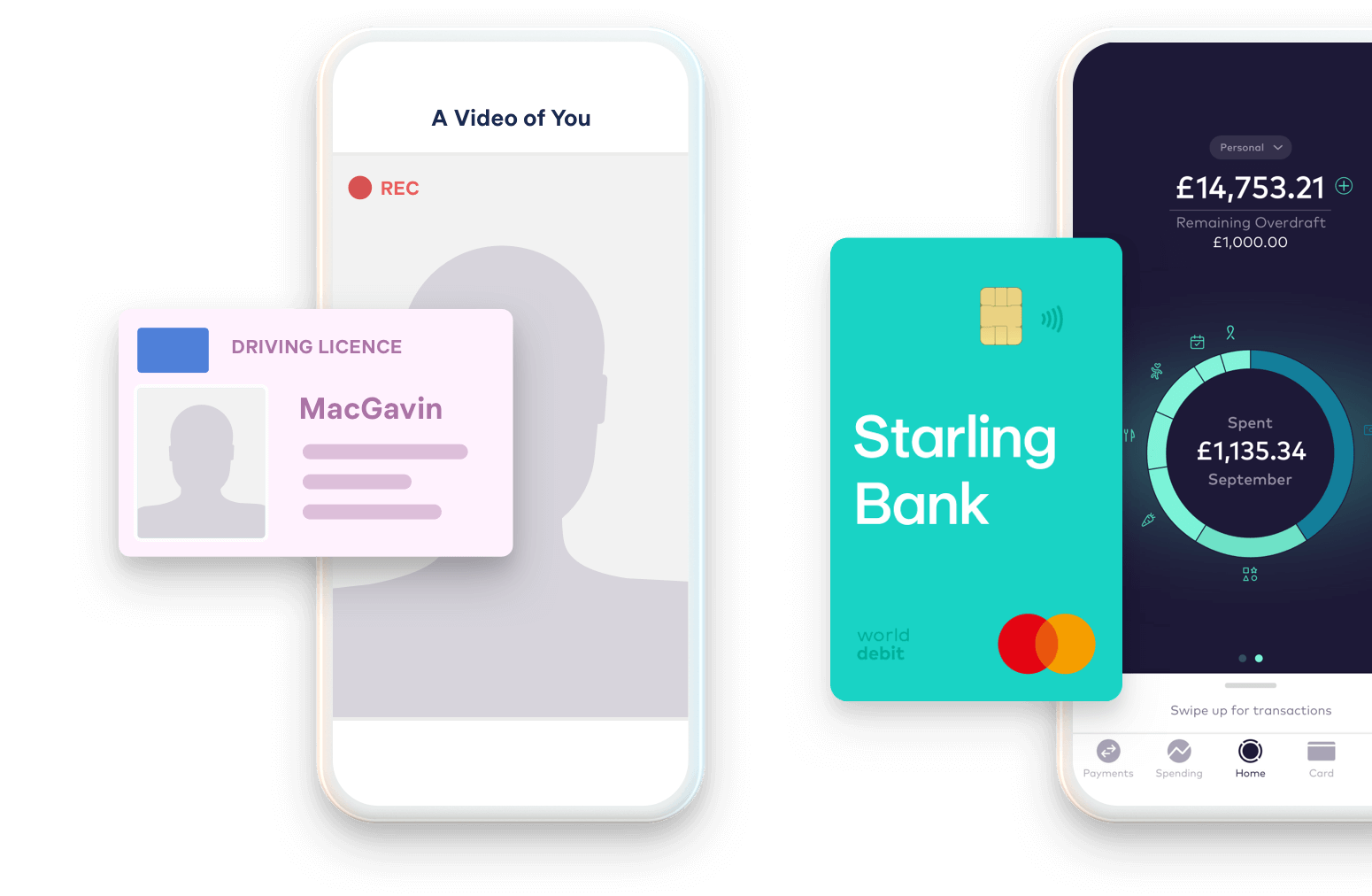

With TIMO you can

1. Get a Domestic NAPAS Debit Card and a Mastercard Credit card

2. Lock your Card directly in App – So when you’re travelling all you need is access to WIFI