If you are wondering which product would best suit you, keep reading to get all the information needed to make the right decision for yourself.

1/ Registration and approval

Timo MasterCard Installment

- Timo MasterCard holders can immediately apply for the installment plan if your credit card is active and the validity period of the card is equal or greater than the installment repayment period.

- The approval is carried out online via the Timo app. Any eligible transaction over 3.000.000 VND that are labeled “Create Installment” in the Timo app can be converted into installments. You can receive the confirmation of your installment status within 1 day* from application. *Only applicable on working days

Fast Cash

Fast Cash

Timo’s cardholders can easily register for Fast Cash in the Timo app within a few minutes. Your application would be approved within 30 minutes during working hours (Mon – Fri, 8:00 – 16:00)

2/ Criteria for application

Timo MasterCard Installment

To apply for Timo MasterCard Installment, the main criteria for application focus on the transactions needed to be converted into installments, such as:

- Eligible transactions must be over 3.000.000 VND and are labeled “Create Installment” in the Timo app.

- Eligible transactions applied to be converted into installments must be successfully recorded by VPBank

- Eligible transactions must be paid by VNĐ inside Vietnam.

Find out more about other criteria for application here.

Fast Cash

With Timo Fast Cash, you will not need to provide proof of income or mortgage assets in order to apply. There are only 3 qualification criteria for Timo Fast Cash as shown below:

- You have an active Timo Spend Account for at least 180 days.

- Your Spend Account and Goal Save have a minimum average balance of at least 500.000 VND over 180 days.

- Your Spend Account has an average number of deposit transactions of at least 5.000.000 VND over 180 days.

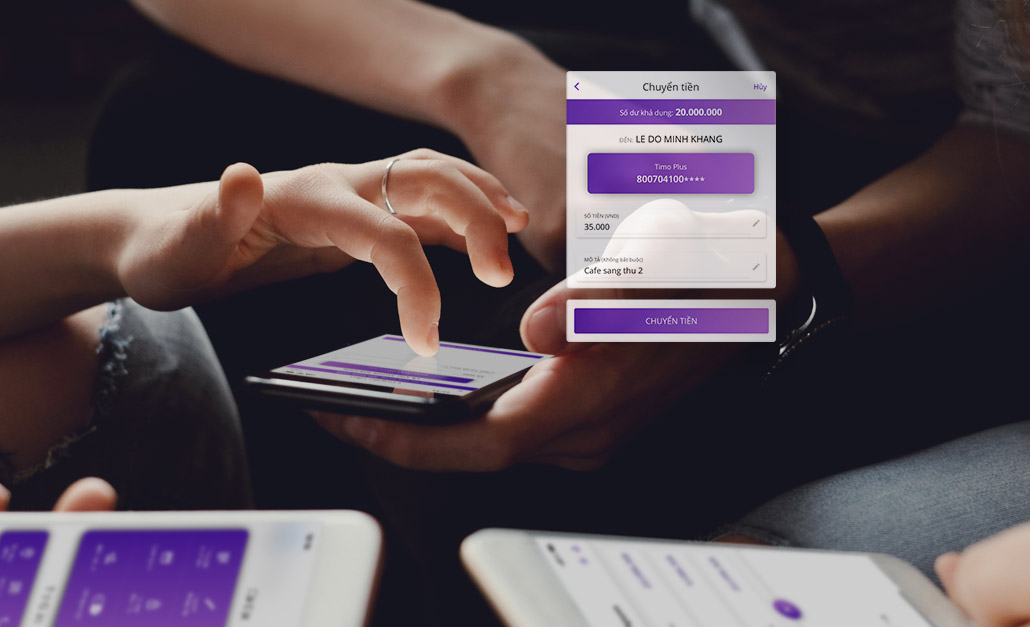

Similar to Timo MasterCard Installment, Fast Cash can also be applied for in the app. Read more about how to activate your Fast Cash here.

3/Limit, interest and payment terms

- Timo MasterCard Installment offers flexible repayment periods of 3, 6 or 12 months. This installment plan does not have a limit, any eligible transaction over 3.000.000 VND can be converted into installments with a low 1% interest rate payable monthly.

- The limit of Fast Cash ranges from 10.000.000 VND to 100.000.000 VND. The maximum repayment period for Fast Cash is within 01 year from the day your Fast Cash is activated. Interest rates may change based on the time of registration, hence, full details about interest will be sent to your registered email address upon applying for Fast Cash.

4/ Characteristics and benefits

- Timo MasterCard Installment: although this feature will help you shop for New Year’s Eve with ease, it allows you to carefully consider if it would be the right decision before converting each transaction into installments. Additionally, since this installment plan is not tied to any specific merchant in Vietnam, you can freely buy whatever your heart desires at any merchant of your choosing. However, this feature can only be used by Timo MasterCard holders with transactions made online and through POS terminals in Vietnam and in VND.

- Fast Cash: this feature offers you additional cash flow with a high limit. Fast Cash can be used to pay utility or shopping bills online, transfer Money and can be used regularly by swiping the Timo Debit card at all POS terminals. However, the money in Fast Cash will only be activated when your Spend Account balance reaches zero. Also, since Fast Cash can be activated with a high limit, you should be careful with your spending to avoid ending up with an excessive amount of debt. You are advised to only use Fast Cash for your daily shopping activities.

Both of the above products have their own distinct advantages that can help you to shop without worrying about going broke this Year-end. Upon understanding clearly the characteristics of both products, you will be able to choose the right feature for yourself to help you prepare better for the upcoming festive celebrations.

Both of the above products have their own distinct advantages that can help you to shop without worrying about going broke this Year-end. Upon understanding clearly the characteristics of both products, you will be able to choose the right feature for yourself to help you prepare better for the upcoming festive celebrations.