After a whole year full of hard work and saving, how much of your account balance you are planning to save with the purpose of generating interest? No matter how much you are planning to put into your savings account, keep in mind that you should choose the kind of savings method that would not make your life difficult. To make this happen, check out how Timo Term Deposit works in the article below, as well as how it would help you to maximize your interest.

1. Start saving now without having to wait

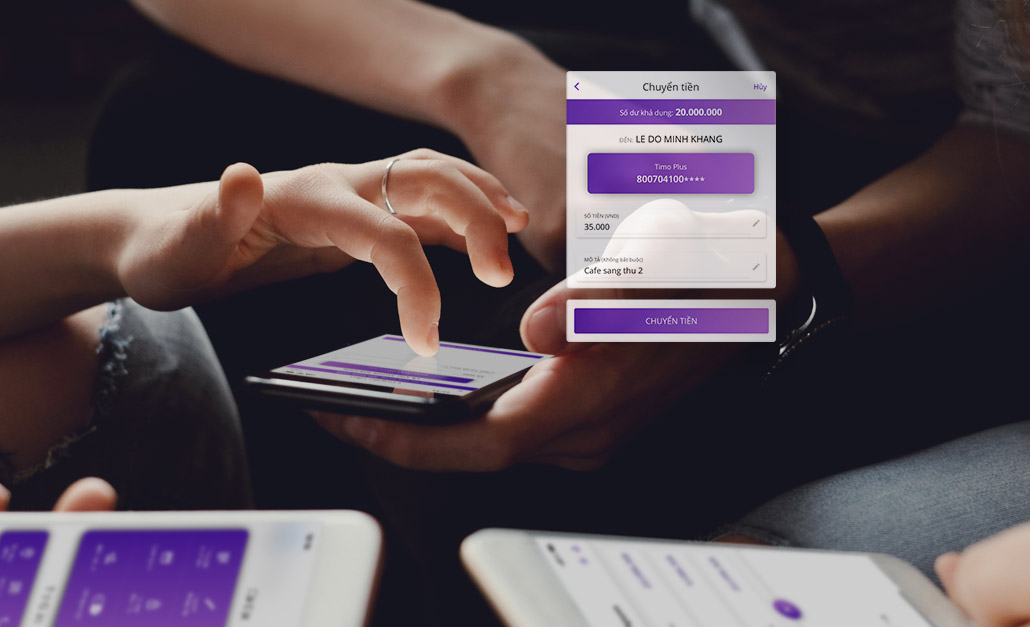

Are you currently waiting for several things to happen in order to start putting your Money into a savings account? For instance, you might be waiting to have enough money to open a savings account, or you already have enough money but are waiting to have free time to visit your bank to open a savings account. With Timo Term Deposit, you will not have to wait any longer as every step and procedure can be done within a blink of the eye in the Timo app. Additionally, Timo Term Deposit offers the following convenient features:

- Low minimum requirement – 1.000.000 VND

- Competitive interest rates – up to 7.6%/year

- Start saving whenever you have money without having to wait for anything as a Term Deposit can be open in the Timo app within a few swipes and taps

Before opening a savings account to earn interest, a lot of people hesitate as they are concerned that they will lose a fair amount of interest if an urgent matter comes up and they end up having to withdraw their money ahead of time. If this is your concern, Timo would be a perfect option as we have a way to help you minimize the loss of interest in these situations.

2/ How to minimize losses of early withdrawal with Timo Term Deposit?

The highest possible interest rate does not always mean that it would help you to generate the largest amount of interest. In an unexpected situation that requires you to withdraw money ahead of time, the higher the interest rate, the higher the amount of interest you would lose. This is why Timo Term Deposit is designed to help you avoid losing a large amount of interest by suggesting users to split their savings amount in smaller accounts. This process can be done quịcly while you are opening a Term Deposit in the Timo app. Upon opening a Term Deposit, depending on the amount of money you wish to save, Timo will suggest you to either open 1 account or split it into 4 accounts. If your savings money is split into 4 Term Deposits, you can easily withdraw 1 during unexpected situations and continue to earn interest on the remaining 3 Term Deposits. With this feature of our Term Deposit, Timo account holders will not need to worry that they would lose all of their interests even when they are in the situation where they need to withdraw some of their savings.

However, be advised that early withdrawal is not always encourage as the best way to maximize your interest is not to withdraw any of your Term Deposits ahead of time.

3/ Unlimited number of Term Deposits is allowed

Hopefully this article is helping you to know how to generate interest from your savings, even with a small amount, as well as how to split your savings account so you would not lose all of your interest in unexpected situations.

Do keep in mind that as Timo Term Deposit encourages users to hold several small accounts, the number of Term Deposits you can open in the Timo app is not restricted. No matter how many Term Deposits you have already opened, you can still easily have another Term Deposit at only 1.000.000 VND.

Don’t leave your savings idle! Put it into work with Timo Term Deposit and enjoy your stress-free savings method brought from Timo!