In parallel with a wide range of traditional types of loans, most banks have now offered overdraft loans. With outstanding benefits such as fast approval, flexible loan limit and simple repayment, overdraft loan is believed to be the suitable “financial savior” for a large number of people.

What is an overdraft loan?

An overdraft loan is an approved amount of Money that allows you to use it, over and above the current balance in your account. With an overdraft loan, your bank will earn interest based on the amount of money you have use from your loan.

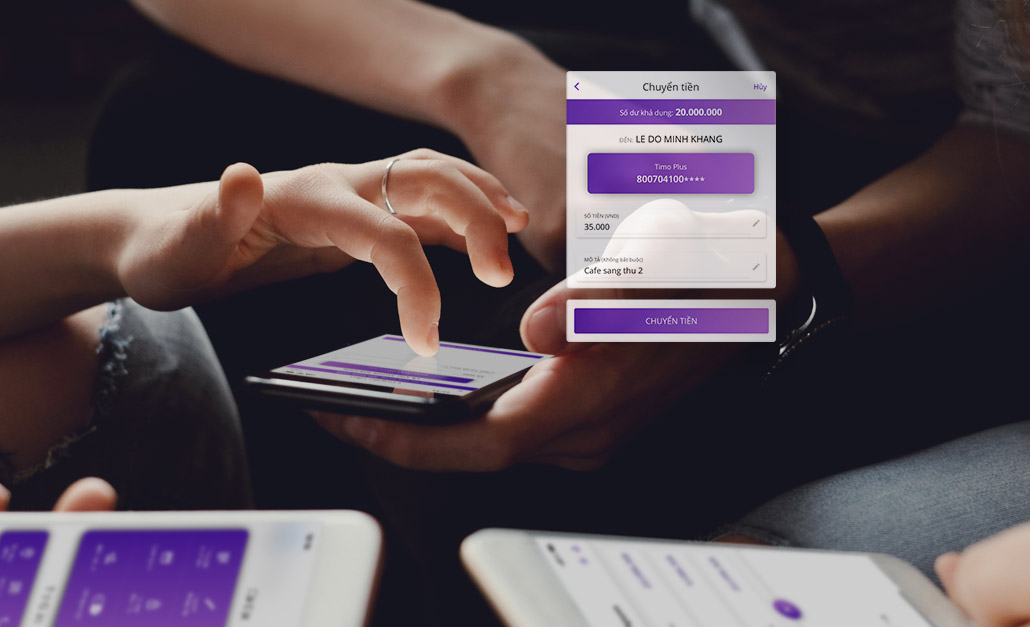

This form of loan is particularly useful for customers who need money to pay for their daily expenses. At Timo, this product, also known as Fast Cash, is offered to you with a goal of making sure it is a fast and convenient “financial savior”. In particular, any application for Timo Fast Cash is reviewed within 30 minutes with a flexible loan limit of up to 100 millions VND. Additionally, compared to other traditional loan types, Timo Fast Cash is more convenient and beneficial in terms of approval process, limit, interest rates, repayment method.

1/ Approval process

Instead of having to prepare a mountain of paperwork to apply for an overdraft loan at traditional banks, the application and approval process for Fast Cash at Timo is significantly fast and simple. You can check to see if you are qualified in the Timo app and apply for Fast Cash in app without having to submit any income proof or mortgage assets. Your application then will be reviewed within 30 minutes.

2/ Loan limit and interest

- Loan limit: You could easily get a Fast Cash limit that is 5 times higher than your monthly income, if you have a monthly income of 20 million VND. To meet different customer needs, Timo Fast Cash varies from 10 to 100 millions VND.

- Competitive interest rate: Although the interest rate for overdraft loans can be higher than interest rates for other loan types, the interest rate for overdraft loans is only calculated based on the actual outstanding overdraft balance and the number of days you have used the loan for. You can easily calculate your loan interest with the following formula:

Your monthly overdraft interest = (Total actual outstanding overdraft balance x Interest rate x Actual number of days the loan is used) / 365

Example: Your issued bank’s interest rate for overdraft loans is 9%. Your actual outstanding overdraft balance (the amount you used from your overdraft loan limit) is 5.000.000 VND and has been used by you for the past 14 days. If this is the case, the amount of interest you would have to pay is equivalent to:

Interest = (5.000.000 x 9% x 14) / 365 = 17.260 VND

3/ Easy repayment method

Instead of having to bring cash to the bank to pay for your overdraft loan, customers using Timo Fast Cash can easily repay for their overdraft loan without having to carry out complicated paperwork. When you top up your Timo Spend Account, the deposited amount will automatically be deducted to repat for your Fast Cash, including interest fees.

Find out more about Timo Fast Cash here.