In an exclusive Interview with the CEO of Vietnams first Digital Bank Timo, Claude Spiese is telling Fintechnews about their business model, the scalability and about some future plans. He explains why his mobile only bank is targeting 50 Millions Vietnamese and claims to be sexy and secure. Moreover this Vietnamese “Bank” is even more functional than US Bank Simple.

Claude Spiese Timo Vietnam CEO

Claude, have you just launched the coolest bank in Vietnam?

Yes! Our design principles – for our app, our website, our marketing, our customer relations, are SSSSH – simple, smart, sexy, secure, human. The result is the coolest bank in Vietnam. Well, technically, VPBank is the bank, Timo is the banking channel, so we are the coolest banking channel in Vietnam.

When was the last time you visited a bank branch?

About two years ago. First I had to open an account. Then I had to apply for a card. Then I had to apply for internet banking. I filled out a lot of forms during several visits to the branch over the course of a week. That’s when I decided enough is enough, Vietnam is ready for a digital bank. Now, with Timo, all of that is possible in 20 minutes at our Hangout over a cup of coffee.

So you decided to launch the first Digital Bank in Vietnam?

Shortly after my Eureka experience at the bank branch, I talked with Don Lam, the key investor for Timo who had a vision of launching Vietnam’s first digital bank. We did some research and found out a few things. Vietnamese hate going to the bank branch (same like me). Vietnamese hate banking fees, especially hidden fees (also same like me). And Vietnamese choose who to do business with depending on two things: the customer experience they receive, and the match of the brand with their lifestyle aspirations (and no lifestyle branded bank exists in Vietnam until now). Of course we also researched internet penetration, smartphone penetration, the success of internet banking initiatives in Vietnam so far, and all that. All research results pointed in one direction – we should launch a lifestyle digital bank in Vietnam ASAP!

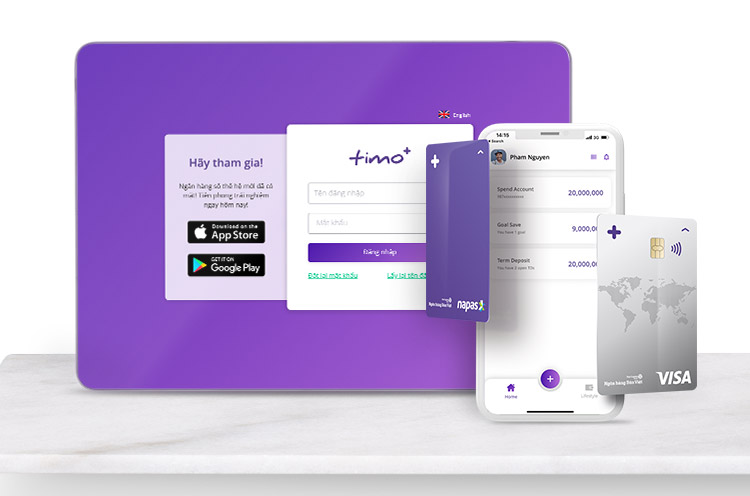

Timo is even more than a digital bank platform like Moven and Simple

Reminds a little about Moven or Simple in the US? Right?

Yes, that’s correct – Timo is a digital bank platform just like Moven and Simple – but Timo takes it one step further. Like Simple and Moven, Timo is a digital front end with a licensed banking partner backend. But, whereas Moven and Simple are limited to one financial product (the current account), Timo serves as a digital platform for a full range of banking products, and even non-banking financial products such as investments and insurance. This model allows Timo to focus on the front end and to deliver an exceptional customer experience while the partner financial institutions focus on the back-end and licenses.

A cool, relaxing Timo Hang Out

Tell us more about Timo Hangout, this sounds kind of virtual?

No, no, it’s real, not virtual! When you build a digital business, it’s important that you have a real, physical component if you expect your customers to believe and trust you. That’s actually the main reason for our Hangout, to make us real in the customer’s mind. Of course it also serves as a great location for face-to-face customer interaction, especially since the sign-up procedure is required by law to be face-to-face. So we provide a cool, relaxing environment for all this – the Timo Hangout.

How difficult is it to bring the 60,000 people from your waiting list into your coffee shop?

Well, unfortunately, in the world of digital marketing, there is drop-off. Our acquisition rate after drop off is currently at a 10% – very good from a market benchmark perspective. Generating 60,000 leads a month means we can sign-up about 6,000 a month. The task for our team is to both increase the leads as well as increasing the acquisition rate higher! Right now, 80-90% of our sign-ups occur at our Hangout, the rest at pop-up hangouts, at public cafes, or at the customers’ office. In October, we will open our Hanoi Hangout. And we have a few other things up our sleeve. Of course, the ultimate objective is to do Digital KYC, once the regulator allows. But I bet many customers who join Timo by Digital KYC will still want to visit our Hangout, and they will always be welcome.

40-50 million people will be our target market!

Which are your target customers and how many are out there in Vietnam in this segment? Millenials?

Well, our marketing guys call our target segments early adopters and upwardly mobiles, or urban athletes and family champions. But I consider a target customer any city dweller with a smartphone and 3G who uses a lot of apps. There are about 6 million of them, most in their 20s and 30s, mostly living in Saigon or Hanoi. But we are seeing other segments joining Timo. Some older folks, like me, want to be cool like the youngsters. And some graduates are in a hurry to join the mass affluent. And later we will expand our target segments, so ultimately roughly half of all Vietnamese, maybe 40-50 million people will be our target market.

How do you build trust with your potential customers?

First, we make sure that every potential customer knows that Timo is powered by VPBank, fully licensed and in compliance with all laws, with deposits safely held by a solid and reputable bank. Secondly, we have an impressive physical presence, the Timo Hangout. Lastly, our customers service builds trust in Timo. Once customers experience a few interactions and transactions – visiting the Hangout, calling the call center, using the app – trust is built.

How did you manage to get into a network of 15,400 ATMs to serve Timo debit cards free of charge?

NAPAS, the national payment gateway which links ATMs from most all banks in Vietnam, charges a small fee for withdrawals at ATMs of banks using a card issued by different bank. We subsidize this small fee as a way of thanking Timo customers for holding deposits with us.

How fast can I login into the Banking app? How fast can I top-up my phone?

In the digital world, we measure “fast” by counting gestures. If you have accessed Timo within the last 24 horus, you can access Timo with four gestures by typing a four-digit quick code.

Once you are in Timo, you can top-up your phone 100,000 dong with two gestures. If you want to top up your wife’s phone for 10,000 dong, it takes four gestures. The fastest in Vietnam

The Goal Save and Term Deposit functions seem to be kind of unique. Can you let us know more about that?

Timo innovates traditional retail banking products in a digital way to be more useful to our customers in saving and managing their money.

Our Goal Save account is a 1% interest bearing Current Account with a twist – you can create goals and set up recurring contributions to achieve them. Our digital interface allows t

he customer to set a picture for their goal and indicates whether their contributions are on target or behind. We even work with merchants to give our customers a discount for what they’re saving for.

Our Term Deposit (TD) product helps the customer avoid losing all their interest if they redeem it before the maturity date. For example, if you want to open a 12-month TD for VND 10,000,000, Timo would suggest you open four TDs of 2,500,000 each. As a result, if the customer needs a portion of their deposit amount, they only need to redeem and lose interest on one of their TDs.

How do you get feedback from your customers and what kind of feedback you get?

We get feedback from our customers in many ways. We conduct surveys over the phone and in the Hangout. We study app usage. We track incoming communications by email, at the call center, on our facebook page. Our customers are very cool, they almost always balance praise with suggestions for improvement. We get a lot of ideas on how to make the app even better, and what features to add. A lot of what Timo is now compared to three months ago is because of feedback which we have received during that time.

Expanding to Hanoi, System is scalable even for other countries

Seems like Timo is a perfect example of Word of Mouth Marketing or how you get your customers?

To get started we have three major channels: digital ads, B2B sales force, B2C sales force, and Hangout walk-ins. Once we have critical mass, referrals will become the major channel, which is basically WOM. We also have plans to do some growth hacking with partners, and they have plans to do some growth hacking with us!

Will you expand soon to other cities like Hanoi, Danang, Haiphong, Can Tho, Nha Trang, and will we see more Hangouts in HCMC?

I tell the CEOs of all the banks who want to copy Timo that we intend to open two or three hundred Hangouts! But actually, I plan to open one in HCMC and one in Hanoi. How we plan to expand to the rest of Vietnam, well, if you don’t mind, I won’t answer that question because I don’t want the CEOs of competing banks to find out until it’s too late to copy us.

300 Timo Hangouts?

You system is kind of scalable, so it could also used in other Countries. I am wrong?

You are not wrong, but there’s more. Timo is scalable in three dimensions: adding more and more customers, adding more and more financial products, and expanding to new markets. The growth we are experiencing now (almost 100% month on month) is not going to end any time soon.

Read also, “Digital Bank Timo Targeting Vietnam’s Millennials, The “Simple” for Vietnam”

Bio: Claude Spiese is co-Founder and CEO of Lifestyle Project Management Vietnam Ltd, the company behind Timo.

In twenty years since settling in Vietnam, Claude has worked in management and consulting positions in Fintech for a wide range of companies and organizations, including VinaCapital, Ministry of Finance, State Bank of Vietnam, SCEC, HIFC, Hanoi Stock Exchange, KPMG, and numerous Vietnamese commercial banks.

A US citizen, Claude was born and spent his 20’s and 30’s in Germany, got his MBA at Bond Uni Australia, then settled in Vietnam in his 40’s, and made his late entry into entrepreneurship in his 50’s

According to Fintechnews Singapore